This guide will show you how to set up stop-loss and take-profit orders on LeveX to automatically manage your trading risks and secure profits.

Requirements Before Starting

- A registered LeveX account (How to register an account on LeveX)

- Funds in your futures wallet (How to transfer funds between wallets)

- Basic understanding of futures trading (Understanding futures trading on LeveX)

What Are Stop-Loss and Take-Profit Orders?

Stop-Loss (SL) orders automatically close your position when the price moves against you by a specified amount, limiting your potential losses. This is essential risk management for leveraged trading.

Take-Profit (TP) orders automatically close your position when you reach your profit target, securing your gains without needing to monitor the market constantly.

Method 1: Setting TP/SL When Opening a New Position

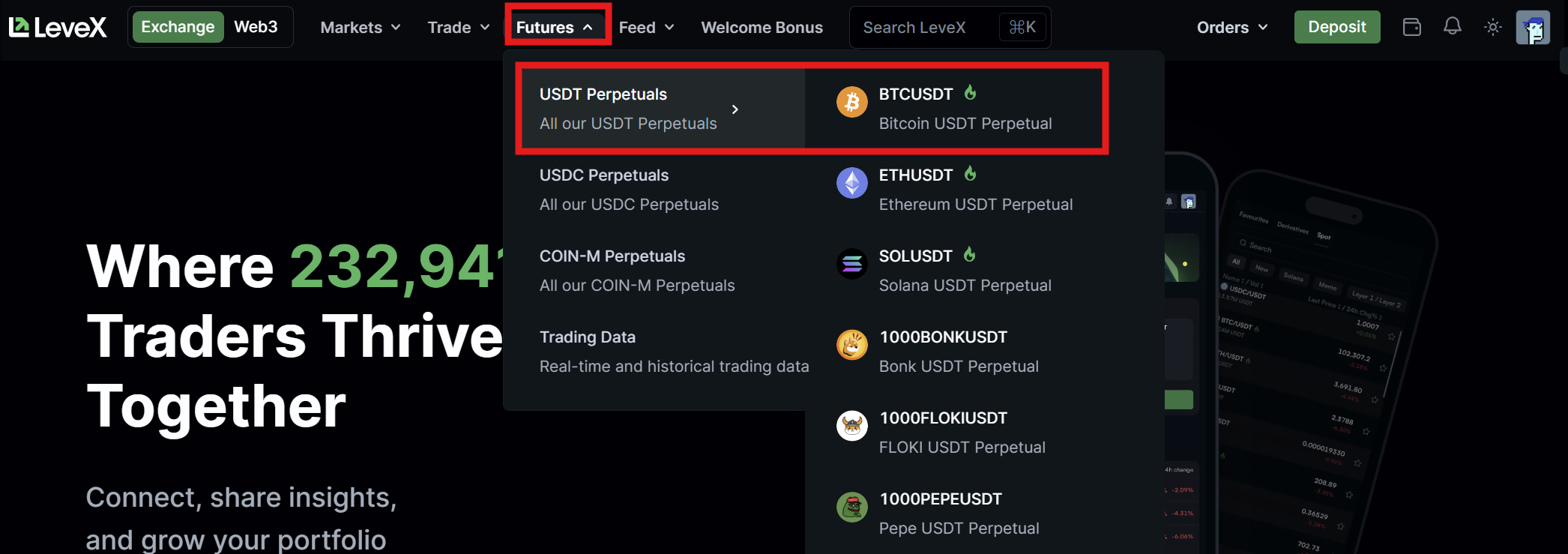

Step 1: Access Futures Trading

Go to the LeveX homepage and hover over "Futures" in the top navigation menu, then select USDT Perpetuals to access Bitcoin futures trading.

Step 2: Select Your Trading Pair

Choose your desired trading pair from the list on the left. For this example, we'll use BTC-USDT perpetual contracts.

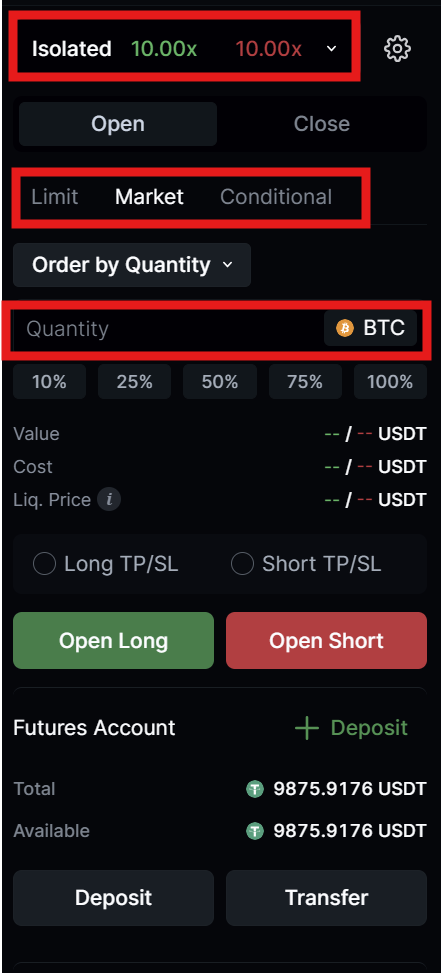

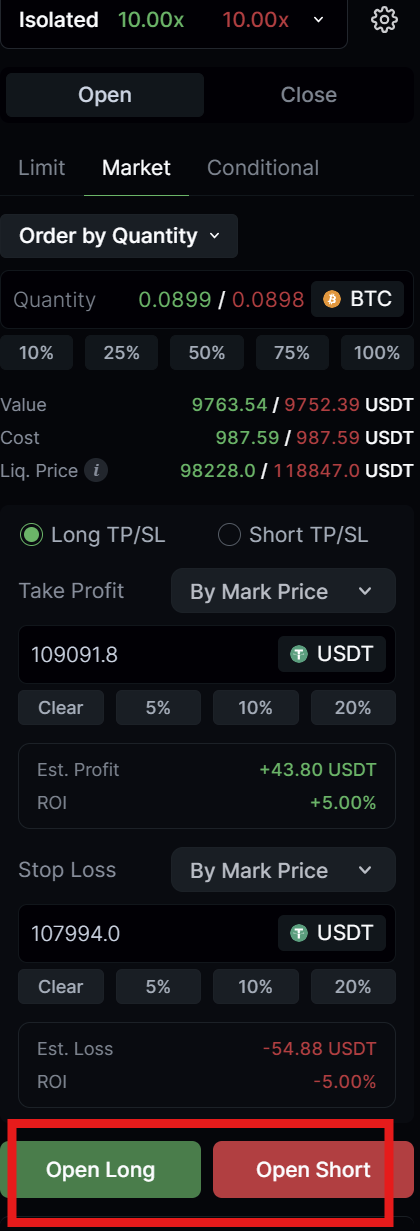

Step 3: Configure Your Position

- Choose your order type (Market, Limit, or Conditional)

- Enter your position size in the Quantity field

- Select your leverage if needed

Step 4: Enable Take Profit and Stop Loss

- Look for the "Take Profit" section in the trading module

- Enable take profit by clicking the toggle or selecting "By Mark Price"

- Enter your take profit price in USDT or use the percentage buttons (5%, 10%, 20%, etc.)

- Look for the "Stop Loss" section below take profit

- Enable stop loss by clicking the toggle or selecting "By Mark Price"

- Enter your stop loss price in USDT or use the percentage buttons

Step 5: Review Your Settings

Before opening your position, verify:

- Your take profit price is set above your entry price (for long positions) or below (for short positions)

- Your stop loss price is set below your entry price (for long positions) or above (for short positions)

- The risk-reward ratio makes sense for your trading strategy

Step 6: Open Your Position

Click either "Open Long" or "Open Short" to create your position with automatic TP/SL orders attached.

Method 2: Adding TP/SL to Existing Positions

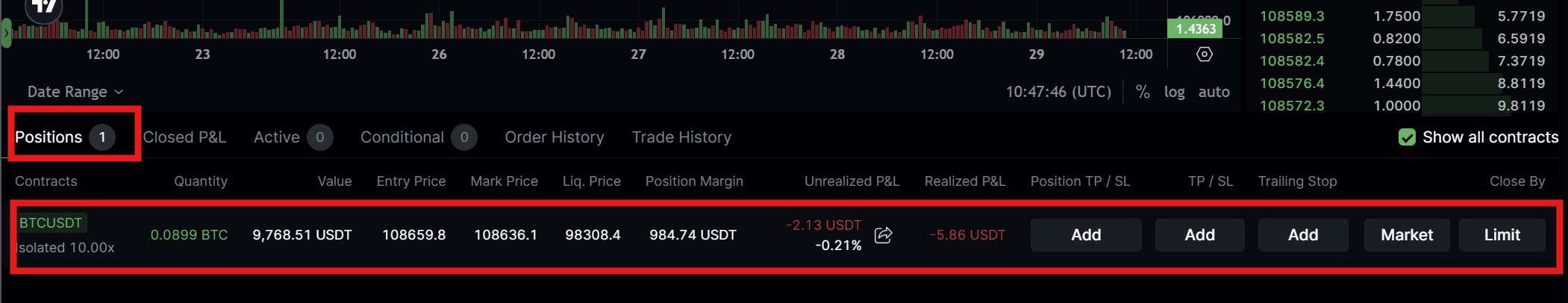

Step 1: Locate Your Open Position

At the bottom of the futures trading interface, find the "Positions" tab. Your active positions will be listed here with details like:

- Contract type (e.g., BTCUSDT)

- Position size and direction

- Entry price and current profit/loss

- Liquidation price

Step 2: Add Take Profit Order

- In your position row, find the "TP/SL" column

- Click the "Add" button under "TP/SL"

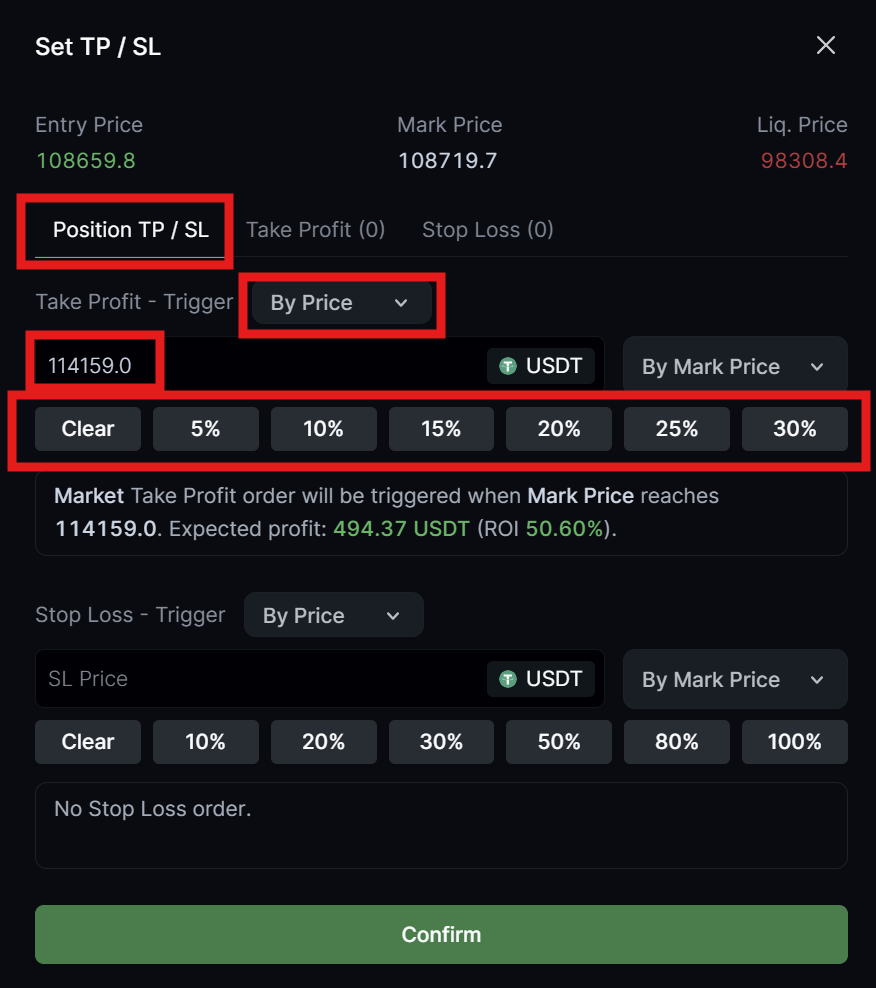

- This opens the "Set TP/SL" popup window

Step 3: Configure Take Profit in the Popup

- Ensure you're on the "Position TP/SL" tab (first tab) in the popup

- In the "Take Profit - Trigger" section, click the dropdown that shows "By Price"

- You'll see three options:

- By ROI: Enter your desired profit percentage to calculate the trigger price automatically

- By Price: Enter a specific price level (we'll use this method)

- By P&L: Enter your expected profit amount to calculate the trigger price

- Select "By Price" for this example

- Enter your take profit price in the "TP Price" field

- Use percentage buttons (5%, 10%, 15%, 20%, 25%, 30%) for quick setup based on your entry price, or click "Clear" to remove

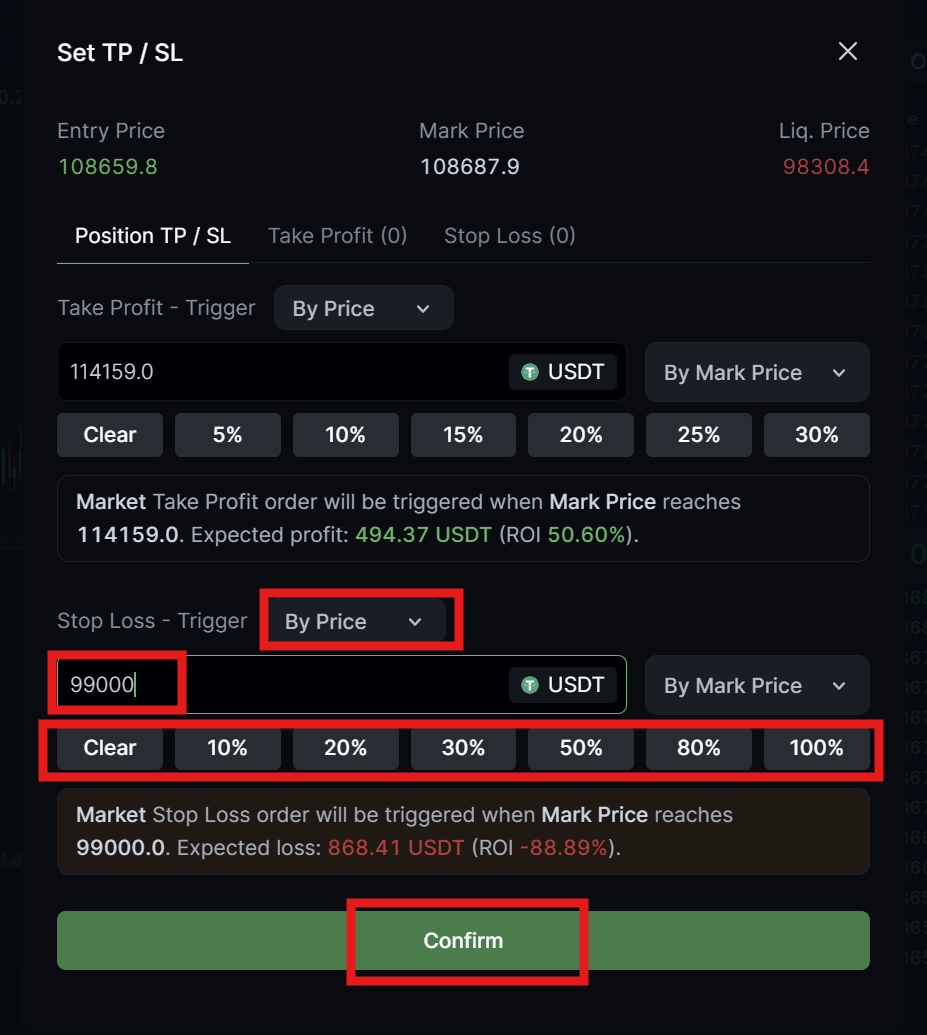

Step 4: Configure Stop Loss

- In the "Stop Loss - Trigger" section below, click the dropdown

- Select "By Price" (same options as take profit are available)

- Enter your stop loss price in the "SL Price" field

- Use percentage buttons (10%, 20%, 30%, 50%, 80%, 100%) for quick setup, or click "Clear" to remove

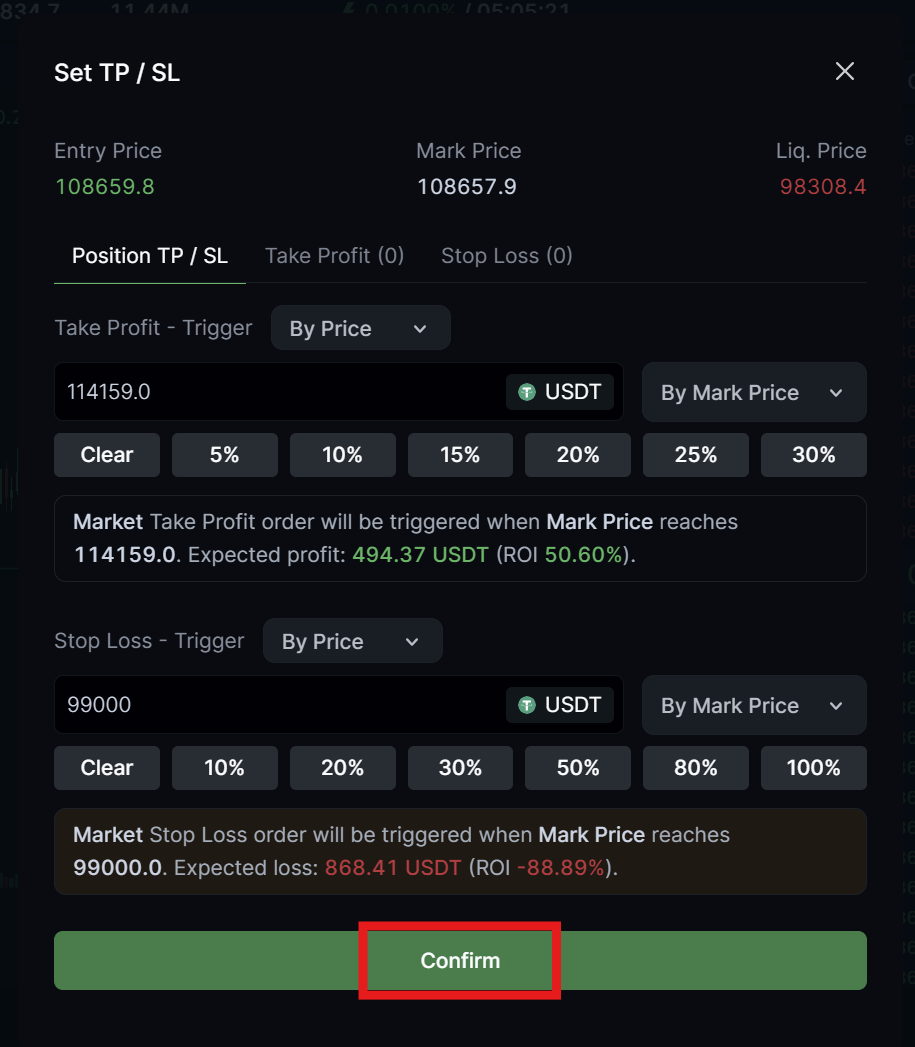

Step 5: Review and Confirm

- Check the "Total Estimated P&L" shown in the popup

- Verify your trigger prices make sense for your position direction

- Click "Confirm" to set your TP/SL orders

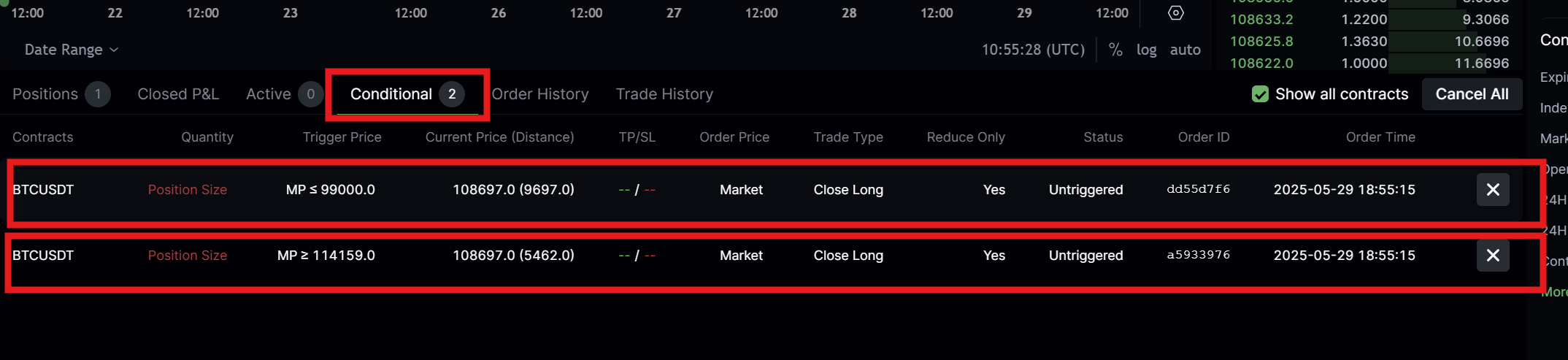

Step 6: Monitor Your Orders

After setting TP/SL orders:

- They will appear in the "Conditional" tab below your positions

- You can modify or cancel them anytime before they trigger

- When triggered, they will execute as market orders

Important Considerations

Market Gaps and Slippage

- TP/SL orders execute as market orders when triggered

- In volatile markets, execution price may differ from your trigger price

- Consider this slippage when setting your levels

Funding Fees

For positions held across funding periods, factor in funding costs when calculating your profit targets.

Liquidation Risk

Ensure your stop loss level is well above your liquidation price to prevent automatic liquidation before your stop loss can trigger.

Best Practices for TP/SL Orders

Before Trading

- Plan your TP/SL levels before entering any position

- Base levels on technical analysis, not arbitrary percentages

- Ensure risk-reward ratio justifies the trade

Position Management

- Consider scaling out profits with multiple TP levels

- Move stop losses to breakeven after reaching first profit target

- Use trailing stops for trending markets

Risk Control

- Always use stop losses on leveraged positions

- Size positions appropriately for your stop loss distance

- Don't move stops against you (don't increase your risk)

Additional Resources

For more information about risk management and trading: