This guide will walk you through opening your first futures trading position on LeveX using different order types.

Requirements Before Starting

- A registered LeveX account (How to register an account on LeveX)

- Funds deposited in your LeveX account (How to deposit funds into your LeveX account)

- Basic understanding of futures trading concepts (Understanding futures trading on LeveX)

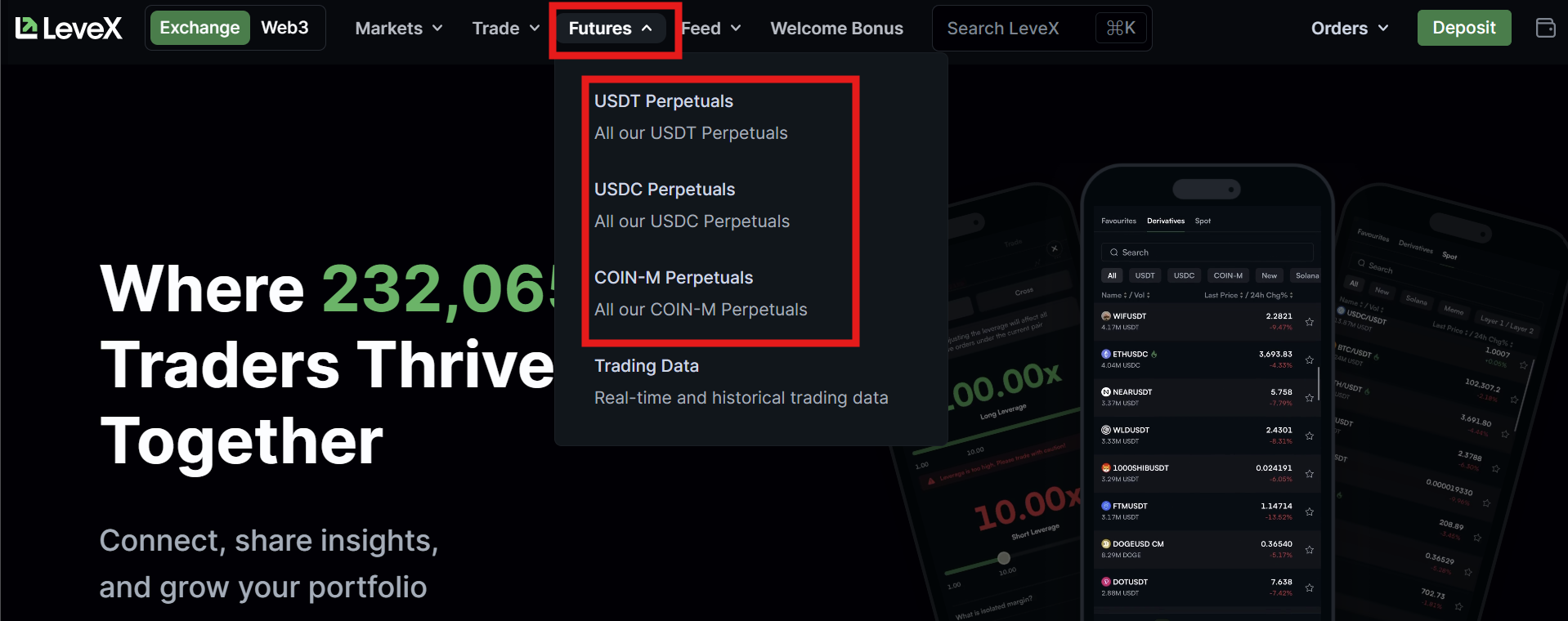

Step 1: Access the Futures Trading Page

Go to the LeveX homepage and hover over "Futures" in the top navigation menu to reveal the dropdown, then select your preferred futures market:

Step 2: Select Your Trading Pair

On the left side of the futures trading interface, find the list of available trading pairs. Click on the cryptocurrency pair you want to trade (for example, BTC-USDT for Bitcoin/Tether perpetual contracts).

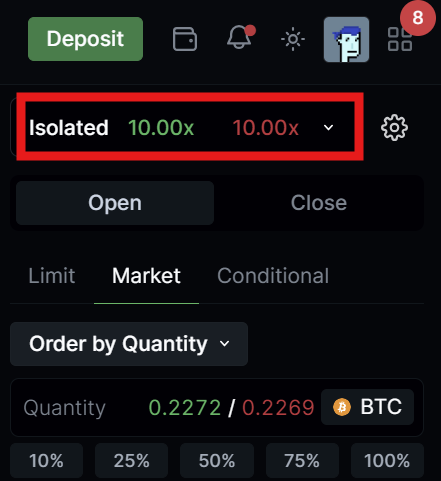

Step 3: Set Your Leverage

In the trading module on the right side of the screen, you can adjust your leverage using the leverage selector. Higher leverage allows you to control larger positions with less margin but increases both potential profits and liquidation risk.

Step 4: Select Your Order Type

Choose from three order types:

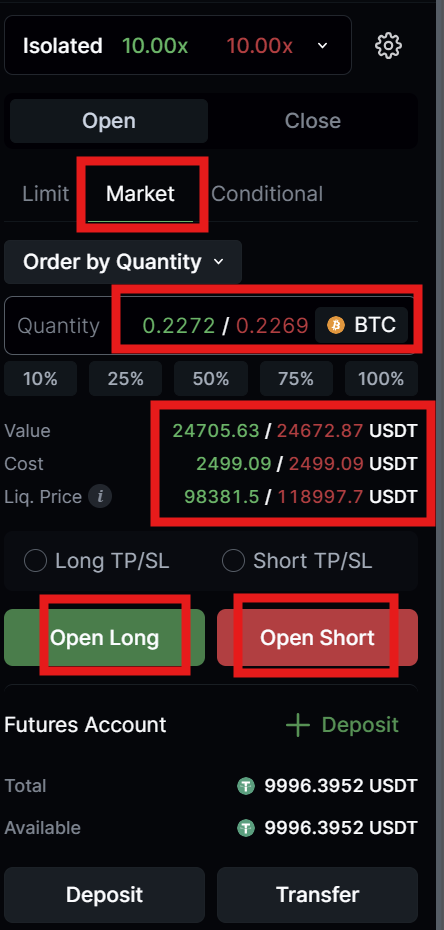

For Market Orders:

- Click the "Market" tab

- Enter the quantity of contracts you want to trade

- Review the estimated execution price and total cost

- Click either "Open Long" or "Open Short" based on your market direction

- Your order will execute immediately at the current market price

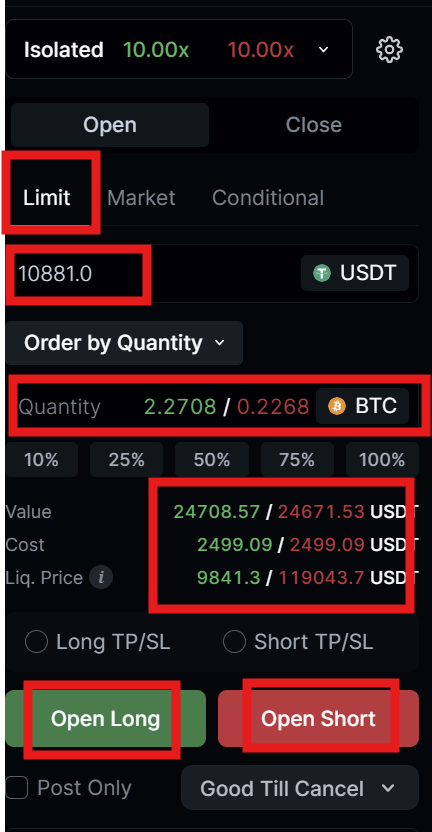

For Limit Orders:

- Click the "Limit" tab

- Enter your desired order price in the price field

- Enter the quantity of contracts you want to trade

- Review the total position value

- Click either "Open Long" or "Open Short"

- Your order will only execute if the market reaches your specified price

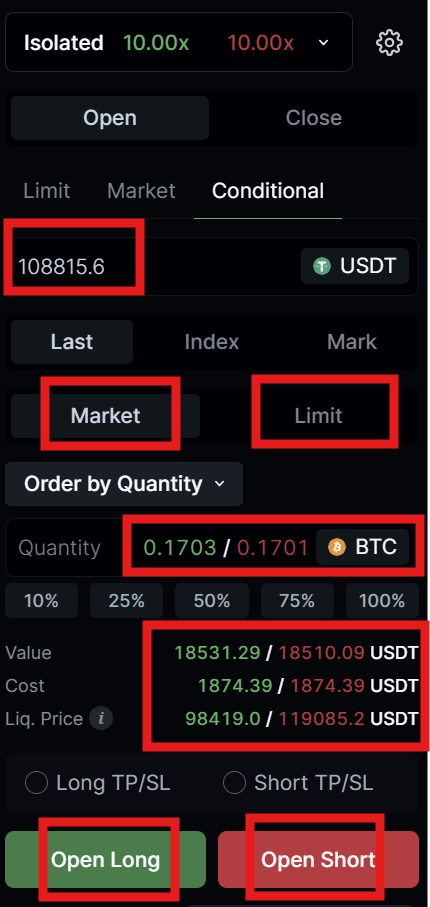

For Conditional Orders:

- Click the "Conditional" tab

- Enter the trigger price that will activate your order

- Choose whether the order as market or limit oder

- Enter the quantity of contracts

- Click either "Open Long" or "Open Short"

- Your order remains inactive until the trigger price is reached

Step 5: Monitor Your Position

After your order executes:

- Your position will appear in the "Positions" tab at the bottom of the trading interface

- Monitor your profit/loss, margin usage, and liquidation price

- You can modify or close your position anytime using the controls in the Positions tab

Important Trading Considerations

Risk Management

- Always set appropriate position sizes relative to your account balance

- Consider using stop-loss orders to limit potential losses

- Monitor your margin ratio to avoid liquidation

- Be aware of funding fees that apply to held positions

Market Conditions

- Market orders execute immediately but may face slippage during volatile periods

- Limit orders provide price control but may not execute if the market doesn't reach your price

- Conditional orders help automate entries but require careful trigger price selection

Position Monitoring

Keep track of your open positions through the Positions tab, which shows:

- Current profit/loss

- Position size and entry price

- Margin requirements

- Estimated liquidation price

- Unrealized PnL

Additional Resources

For more detailed information about futures trading: