This guide explains how to read and interpret order books and market depth on LeveX, helping you make more informed trading decisions.

What Is an Order Book?

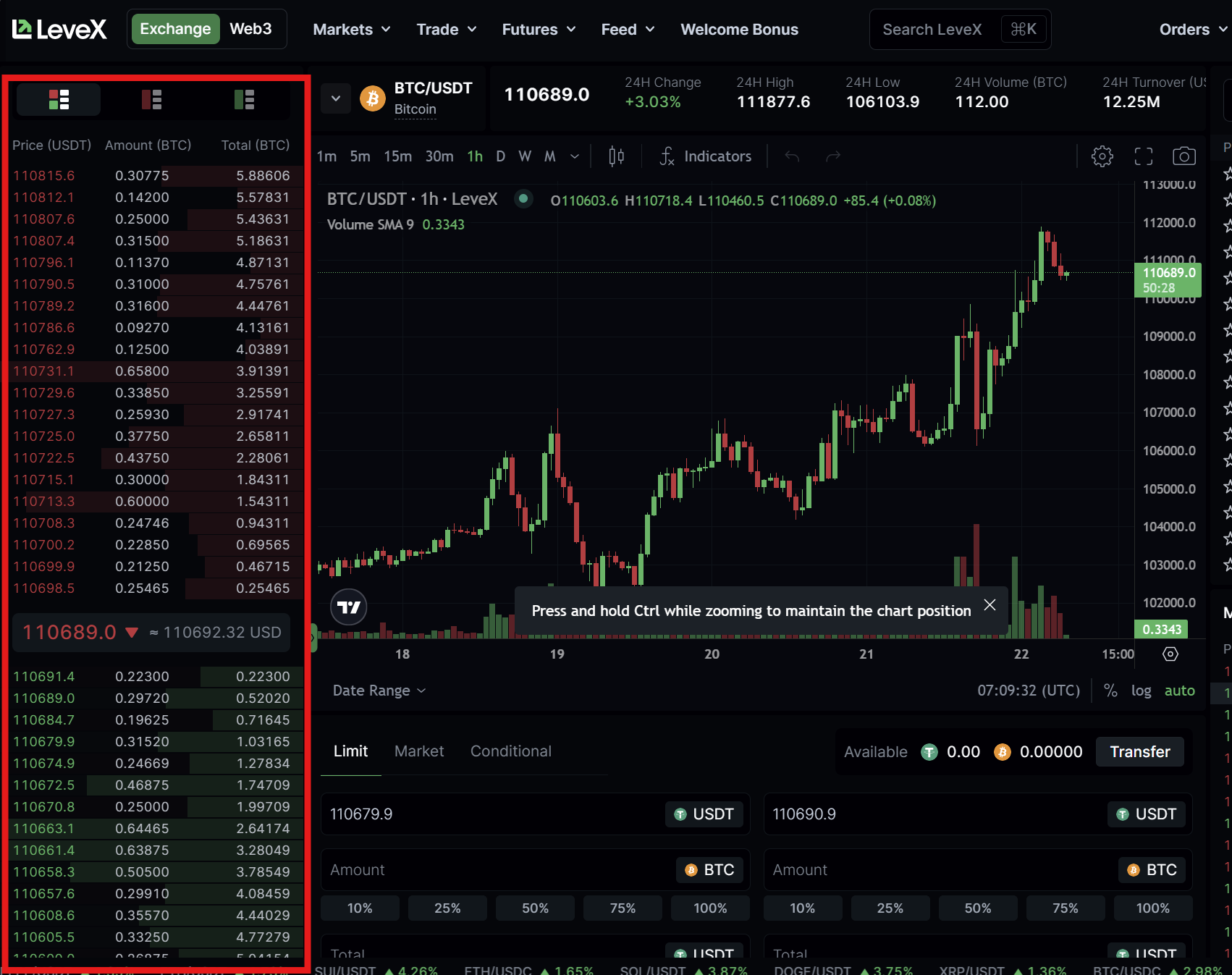

An order book is a real-time, dynamic record of all outstanding buy and sell orders for a specific cryptocurrency trading pair. It represents the current market sentiment and liquidity by showing all the pending orders waiting to be executed. On LeveX, the order book is a central feature of the trading interface that displays the quantity of crypto assets that traders want to buy or sell and at what prices they're willing to transact.

The order book consists of two main sides: the buy side (bids) and the sell side (asks). Buy orders are typically displayed in green, indicating the prices at which traders are willing to purchase the cryptocurrency. Sell orders are usually shown in red, representing the prices at which traders are willing to sell. The difference between the highest bid and the lowest ask is known as the spread, which is an important indicator of market liquidity and volatility.

How to Read the Order Book on LeveX

When you access any trading pair on LeveX, such as BTC-USDT or ETH-USDT, the order book is prominently displayed on the trading interface. To interpret this information effectively:

The buy orders (bids) appear on the left or bottom section, arranged from highest to lowest price. These are orders from traders willing to buy the cryptocurrency at specified prices. The highest bid price represents the current maximum amount someone is willing to pay for the asset.

The sell orders (asks) are displayed on the right or top section, arranged from lowest to highest price. These are orders from traders looking to sell at their specified prices. The lowest ask price is the minimum amount someone is currently willing to accept for the asset.

The spread is the difference between the highest bid and the lowest ask. A narrow spread generally indicates a liquid market with high trading activity, while a wider spread suggests lower liquidity and potentially higher volatility.

Each price level in the order book shows the quantity of cryptocurrency available at that price, as well as sometimes the cumulative quantity (the total amount available up to that price level). This information helps you understand how much buying or selling pressure exists at different price points.

How to Use Order Book Information for Trading

Order book analysis can significantly enhance your trading strategy on LeveX. Here are some practical ways to use this information:

Identifying Support and Resistance Levels

Large clusters of buy orders often create support levels where prices may bounce back up if they fall to that point. Similarly, large clusters of sell orders create resistance levels that may prevent prices from rising further. By identifying these levels in the order book, you can make more informed decisions about entry and exit points for your trades.

For example, if you notice a significant accumulation of buy orders at a certain price below the current market price, you might consider setting a buy order slightly above this level, anticipating that the price will rebound from this support.

Gauging Market Sentiment

The distribution of orders in the order book provides insights into market sentiment. If there are more buy orders than sell orders, particularly at prices close to the current market price, it suggests bullish sentiment. Conversely, a higher volume of sell orders indicates bearish sentiment.

Look for imbalances between buy and sell orders as they can signal potential short-term price movements. A significantly higher volume on one side might indicate that the price is likely to move in that direction.

Detecting Potential Market Manipulation

Large orders that suddenly appear in the order book, only to disappear before being executed, may indicate attempts at market manipulation through a practice called "spoofing." These fake orders are placed to create an illusion of buying or selling pressure, potentially influencing other traders' decisions.

By continuously monitoring the order book for unusual activities, such as the sudden appearance or disappearance of large orders, you can avoid being misled by these manipulative tactics.

Planning Order Execution

The order book helps you plan your order execution strategy. For market orders, you can estimate potential slippage by looking at the available liquidity at different price levels. If you're placing a larger order, you might decide to split it into smaller parts to minimize market impact, especially if the order book shows limited liquidity.

When placing limit orders, the order book can help you determine optimal price levels. By placing your order at a price level with many other orders, you increase the likelihood of it being filled during a market movement to that level.

You can practice these strategies on different market pairs on LeveX, such as BTC-USDT for spot trading or BTCUSDT for futures trading.

Common Order Book Patterns and What They Mean

Certain patterns in the order book can provide valuable trading signals:

A balanced order book shows similar volumes on both the buy and sell sides, suggesting a market in equilibrium. This often indicates a period of consolidation before a significant price movement.

Buy or sell walls are large orders at specific price levels. A buy wall may indicate strong support, while a sell wall suggests strong resistance. However, be cautious as these walls can sometimes be removed suddenly if they're part of a manipulation strategy.

Thin order books with low volumes across multiple price levels indicate low liquidity, which often leads to higher volatility. In such markets, even relatively small orders can cause significant price movements.

Clustered orders at specific price levels, particularly at psychologically significant numbers (like $10,000, $50,000 for Bitcoin), often represent important support or resistance zones that traders should pay attention to.

If you want to see these patterns in action, you can observe real-time order books on LeveX's trading pages for popular pairs like BTC-USDT or SOL-USDT.

Limitations of Order Book Analysis

While the order book provides valuable information, it's important to understand its limitations:

The order book only shows limit orders, not market orders. Since market orders are executed immediately against existing limit orders, they don't appear in the order book but can significantly impact the market.

Order books are dynamic and change rapidly, especially in volatile markets. What you see at one moment might change completely within seconds.

Not all trading intentions are reflected in the order book. Some traders, particularly large institutional players, may use iceberg orders (where only a portion of the total order size is visible) or execute trades through over-the-counter (OTC) markets, which don't appear in the public order book.

Conclusion

Understanding how to read order books and interpret market depth on LeveX is a fundamental skill for cryptocurrency traders. By mastering order book analysis, you gain insights into market liquidity, sentiment, and potential price movements that aren't available through price charts alone.

Use this information as part of your broader trading strategy, combining order book analysis with technical indicators, fundamental analysis, and risk management principles. With practice, you'll become more adept at spotting patterns and opportunities in the order book, potentially improving your trading outcomes on LeveX.

Ready to practice reading order books? Visit LeveX's trading pages for popular pairs:

For more trading guides, check out the LeveX Support Center or LeveX Blog for additional educational resources.