Understanding Order Types: Limit, Market, and Conditional Orders

Introduction to Order Types

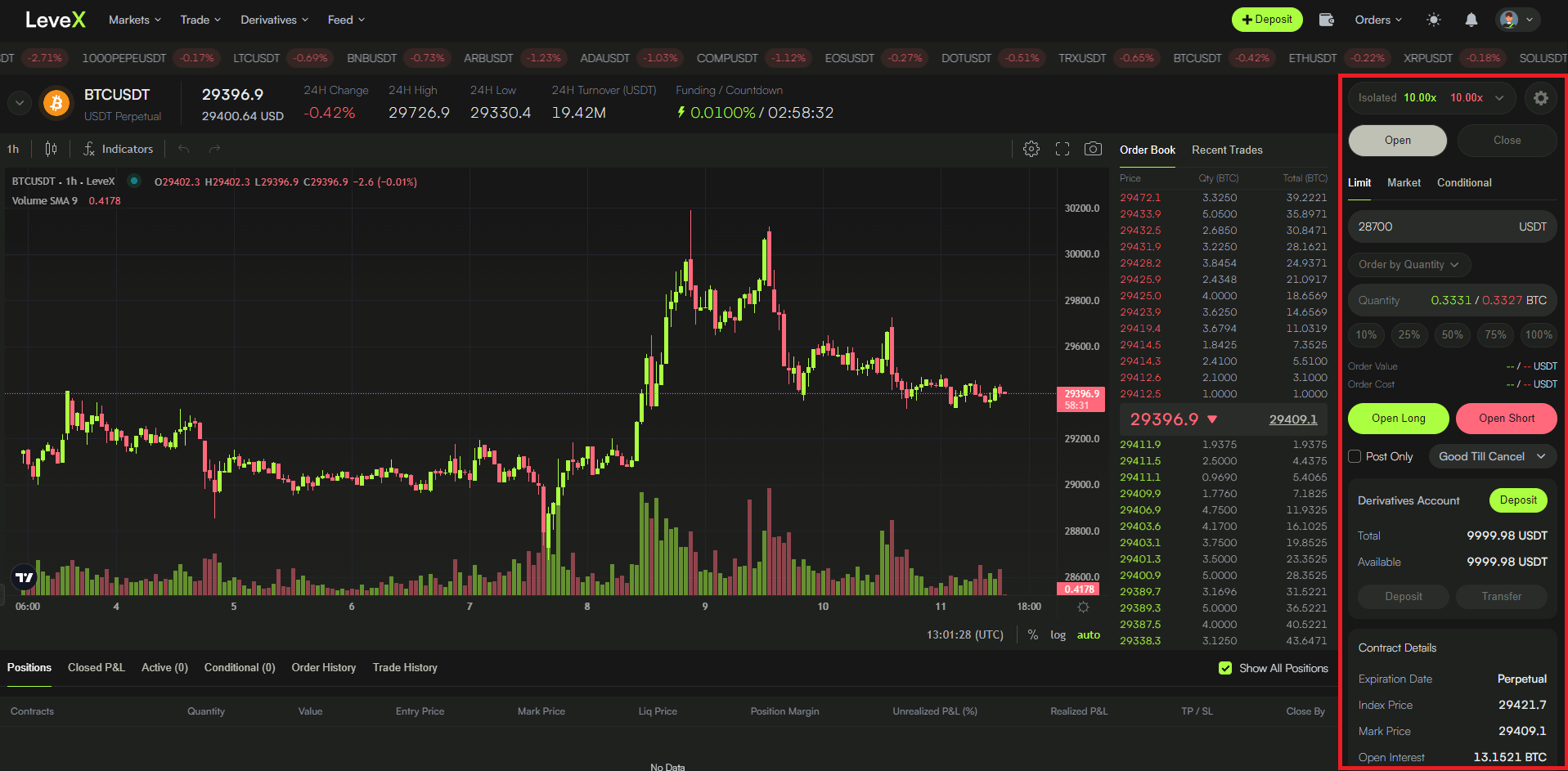

Order types are the instructions traders provide to their broker or trading platform about how to execute a trade. Understanding different order types is essential for implementing a variety of trading strategies and controlling the execution of trades. In this guide, we'll explore three common order types: Limit, Market, and Conditional Orders, and how they are utilized on platforms like LeveX.

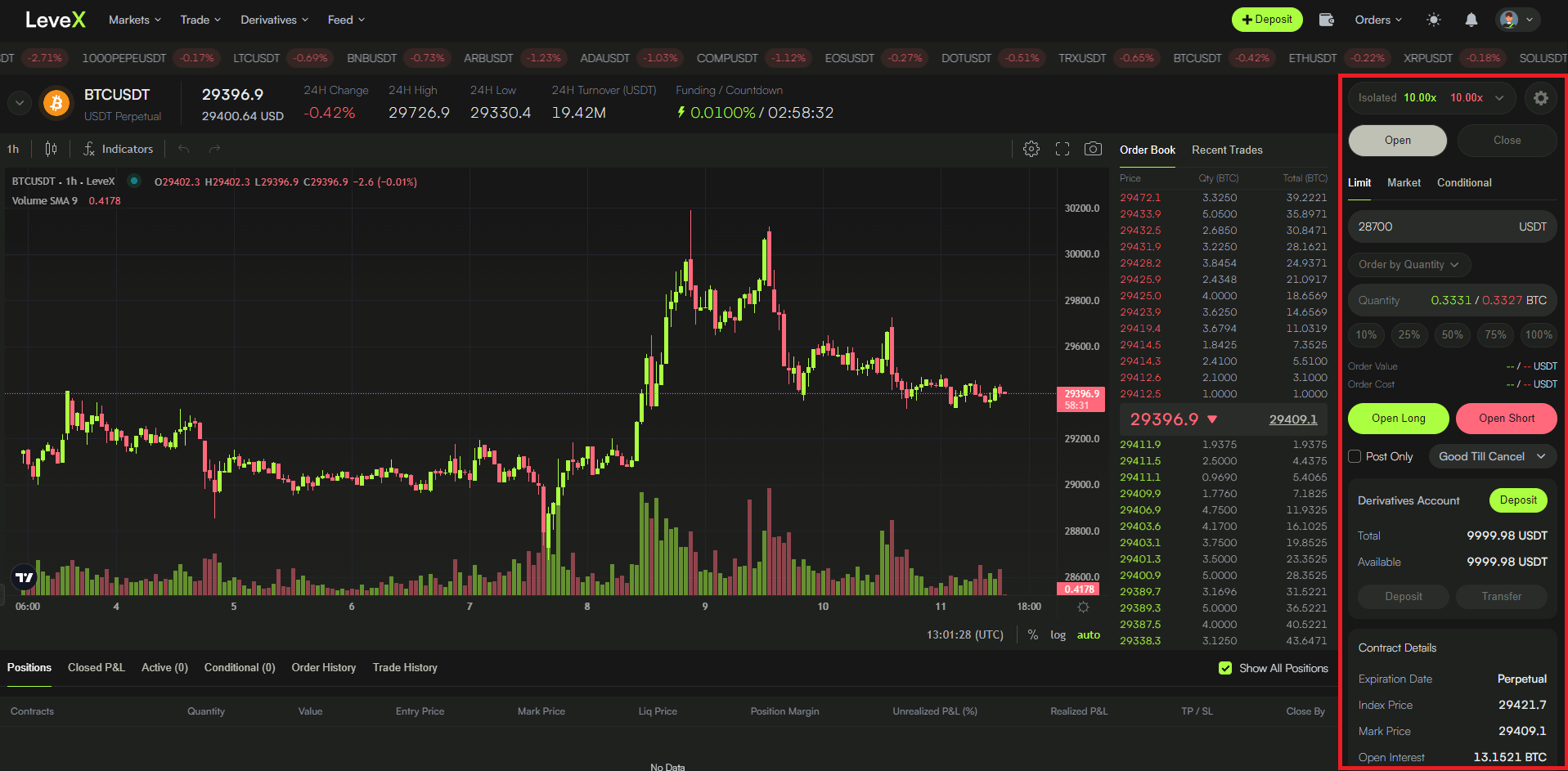

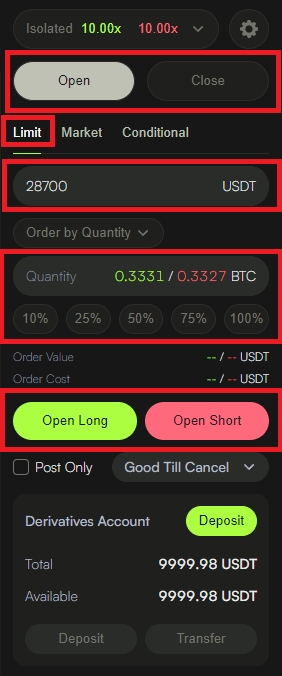

Limit Orders

A Limit Order is an instruction to buy or sell a contract at a specific price or better. It allows traders to set the exact price at which they want to trade.

- - Buy Limit Order: Executed at the limit price or lower.

- - Sell Limit Order: Executed at the limit price or higher.

Advantages:

- Greater control over the price at which a trade is executed.

- Potentially avoids paying more than a certain price when buying or receiving less when selling.

Disadvantages:

- The order may not be executed if the market doesn't reach the specified price.

Market Orders

A Market Order is an instruction to buy or sell immediately at the current market price. It guarantees execution but not the price.

Advantages:

- Quick execution.

- Suitable for fast-moving markets.

Disadvantages:

- Price can vary significantly from the time the order is placed to the time it's executed.

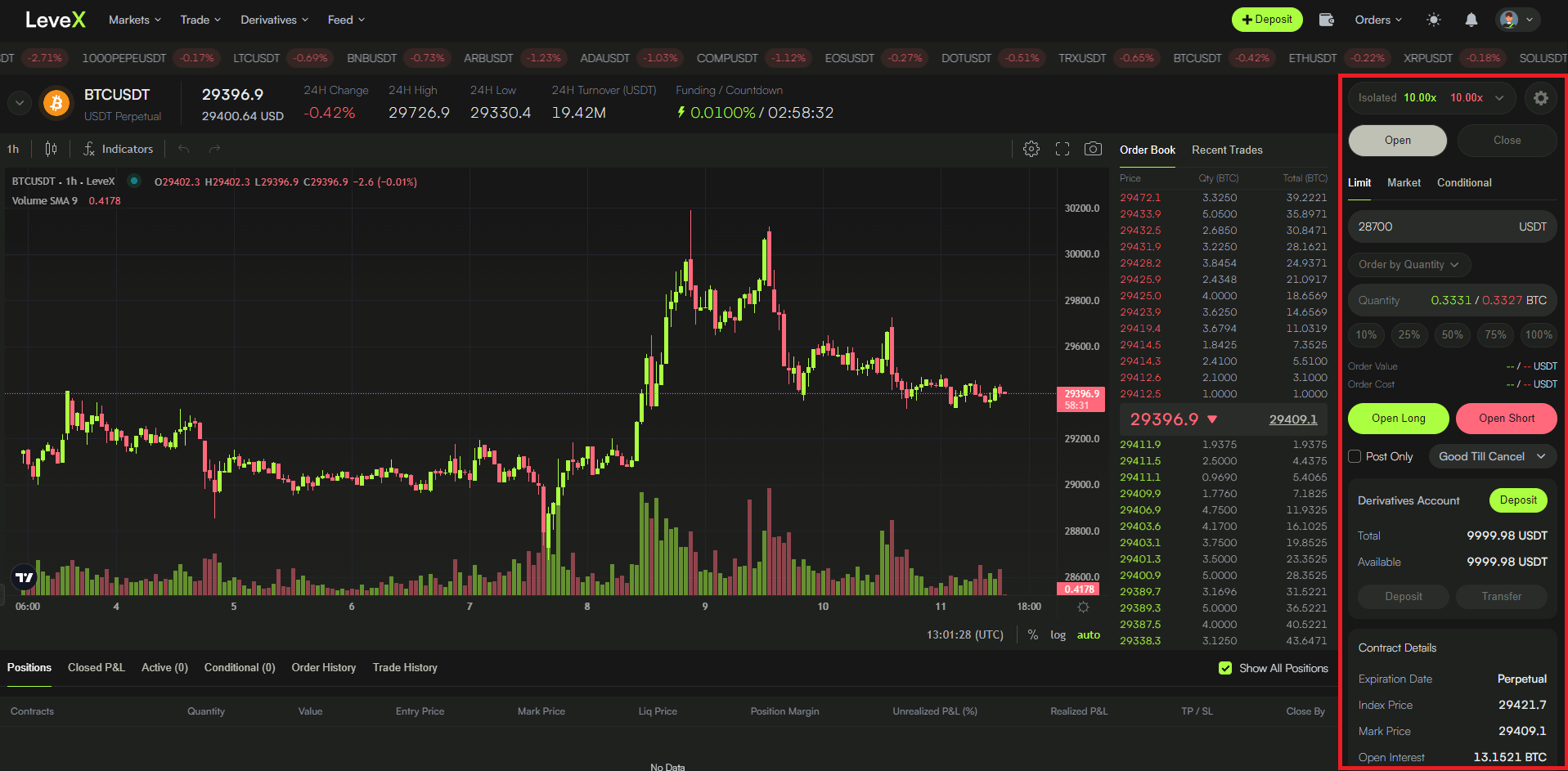

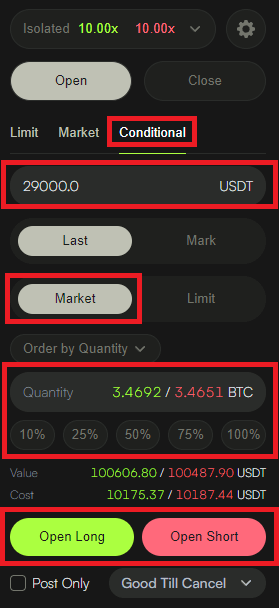

Conditional Orders

- Conditional Orders are set to execute when certain predetermined conditions are met, like reaching a specific price trigger. There are two main types of Conditional Orders: Conditional Market Orders and Conditional Limit Orders.

- Conditional Limit Orders: These allow you to set a trigger price to send a limit order when the trigger is hit. The limit order also has its own limit price, so it would only execute when and if that limit price is reached. Prior to the trigger price getting reached, the limit order won't even be in the order book.

Advantages:

- Automation of trading strategies based on specific conditions.

- Greater control over trade execution through precise triggers and limits.

Disadvantages:

- Complexity in setting up and understanding the relationship between trigger and limit prices.

LeveX offers all of these order types to provide traders with the flexibility and control needed for different trading strategies. Traders can easily select and configure these orders within the LeveX trading interface, taking advantage of the nuanced control that these functions provide.

🔗 Connect & Thrive with LeveX

Follow us on our social media channels to stay up-to-date with the latest news, announcements, and exclusive offers.

Facebook 📘 | Twitter 🐦 | LinkedIn 🔗 | Instagram 📷 | YouTube 📺

For more information on related concepts, please refer to LeveX's User Guides or contact our dedicated Customer Support.