Understanding Contract Pairs in Futures Trading

Introduction to Contract Pairs

In the world of futures trading, a contract pair consists of two currencies. These pairs form the basis of most trading contracts, allowing traders to speculate on the relationship between two different financial assets. Think of it as trading the value difference between two currencies, one serving as the base and the other as the quote currency.

For example, in the BTC/USDT pair:

- BTC is the base currency.

- USDT is the quote currency.

The price represents how much of the quote currency (USDT) is required to purchase one unit of the base currency (BTC).

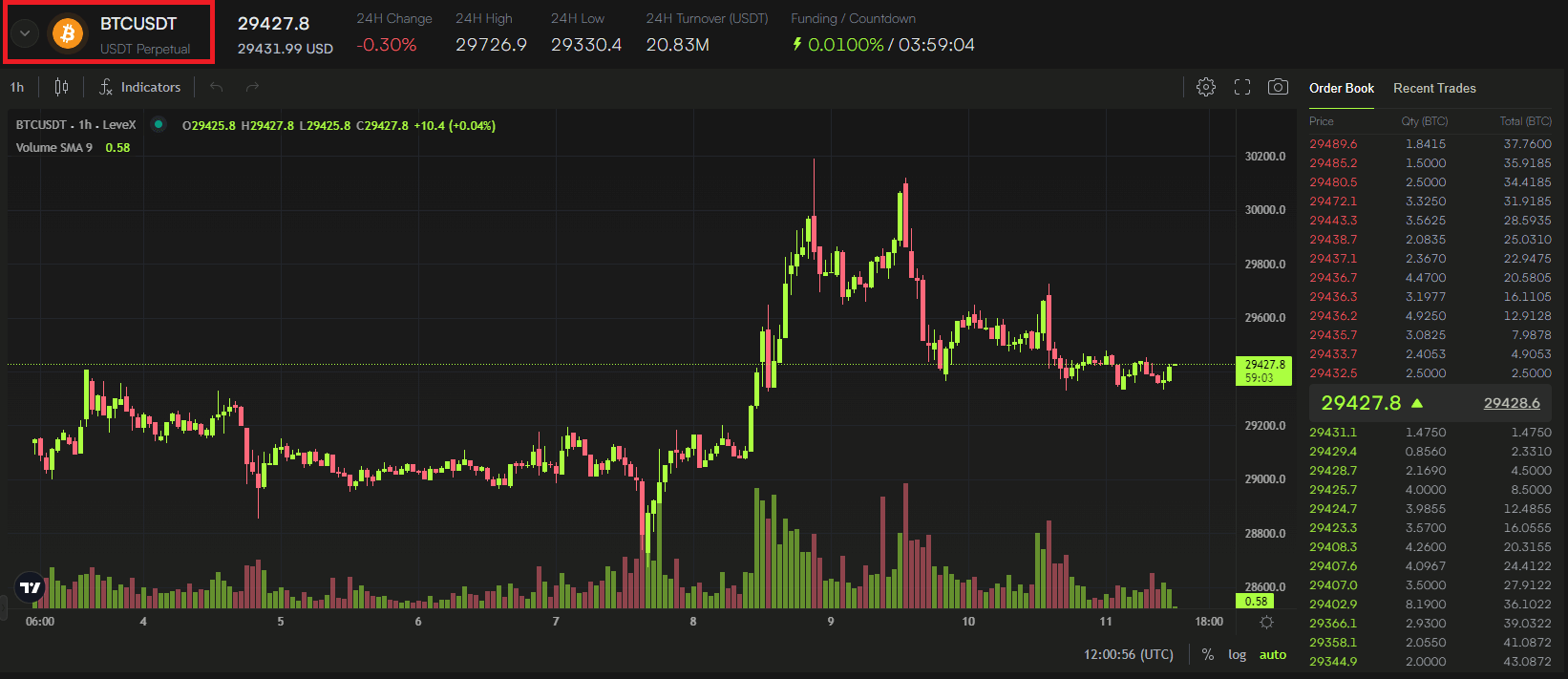

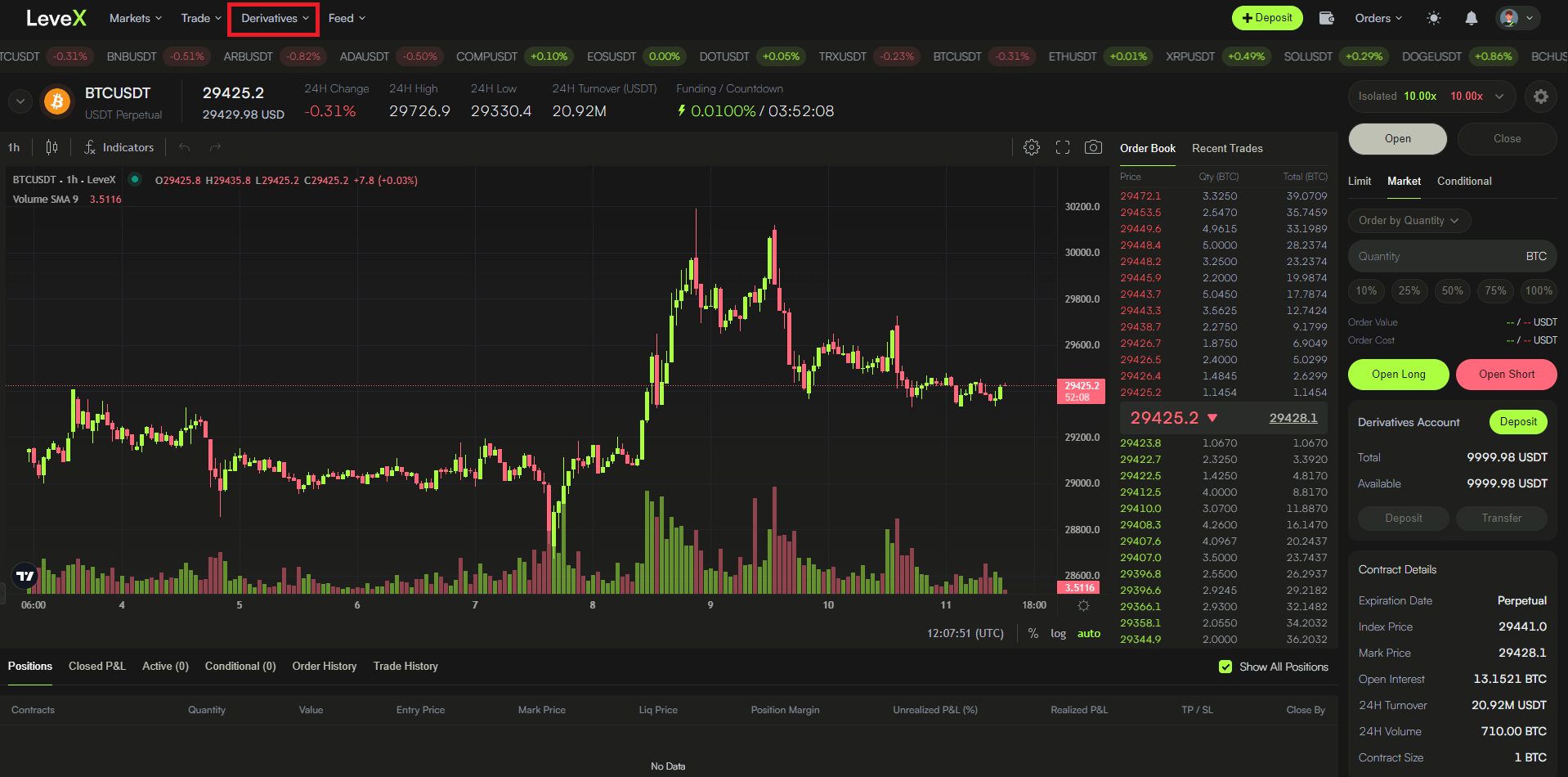

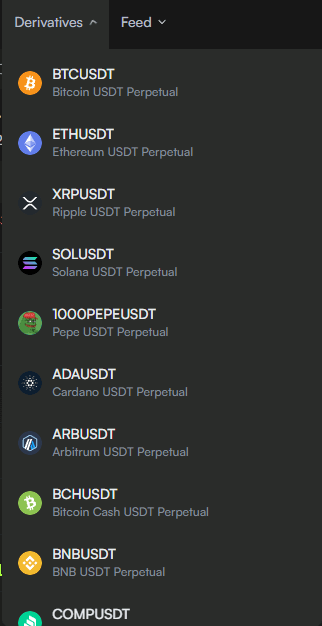

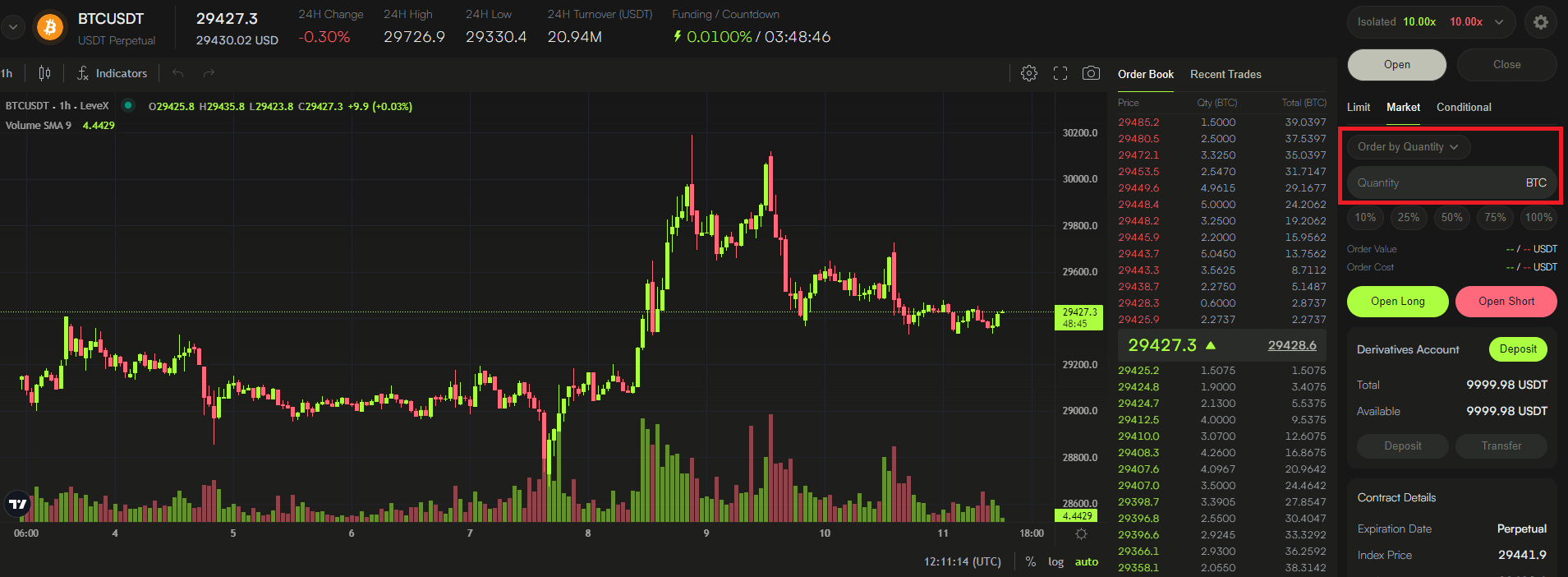

Contract Pairs on LeveX

LeveX, like many trading platforms, utilizes contract pairs in futures trading. In the context of LeveX, the contract size for the BTC/USDT pair is 1 BTC. This means that for every contract you trade, you are essentially controlling 1 BTC.

When a user wants to long BTC, they are actually trading the BTC/USDT contract. They are betting that the price of BTC will rise against USDT.

Here's how it would work:

- Let's say you want to trade a $15,000 worth position.

- Assume the current price of BTC is $30,000.

- You would be putting an order for 0.5 contracts since 0.5 BTC equals $15,000 at the given price.

Another important concept to understand is Funding Fees. Since you’re not actually trading Bitcoin, but rather a separate asset that follows Bitcoin’s price, a funding fee is the mechanism that helps the price stay tethered.

🔗 Connect & Thrive with LeveX

Follow us on our social media channels to stay up-to-date with the latest news, announcements, and exclusive offers.

Facebook 📘 | Twitter 🐦 | LinkedIn 🔗 | Instagram 📷 | YouTube 📺

For more information on related concepts, please refer to LeveX's User Guides or contact our dedicated Customer Support.