Understanding Future Trading (Perpetual Contracts) on LeveX

Introduction to Futures

Futures are financial contracts that derive their value from an underlying asset or group of assets. Imagine you're making a deal with someone about the future price of something, like gold. Instead of buying the gold now, you both agree on a price for a later date. If the price of gold goes up, one person wins, and if it goes down, the other person wins. futures work in a similar way, often used to speculate on changes in prices or to protect against potential losses.

In more technical terms, futures can be tied to various underlying components like stocks, bonds, commodities, currencies, interest rates, or even other futures. Common types of futures include options, futures, and swaps. They can be used for various purposes such as hedging (protecting against risk), speculating (betting on future price movements), or arbitraging (taking advantage of price differences in different markets). Understanding futures requires some care, as they can be complex and entail significant risks, but they are an essential part of modern financial markets.

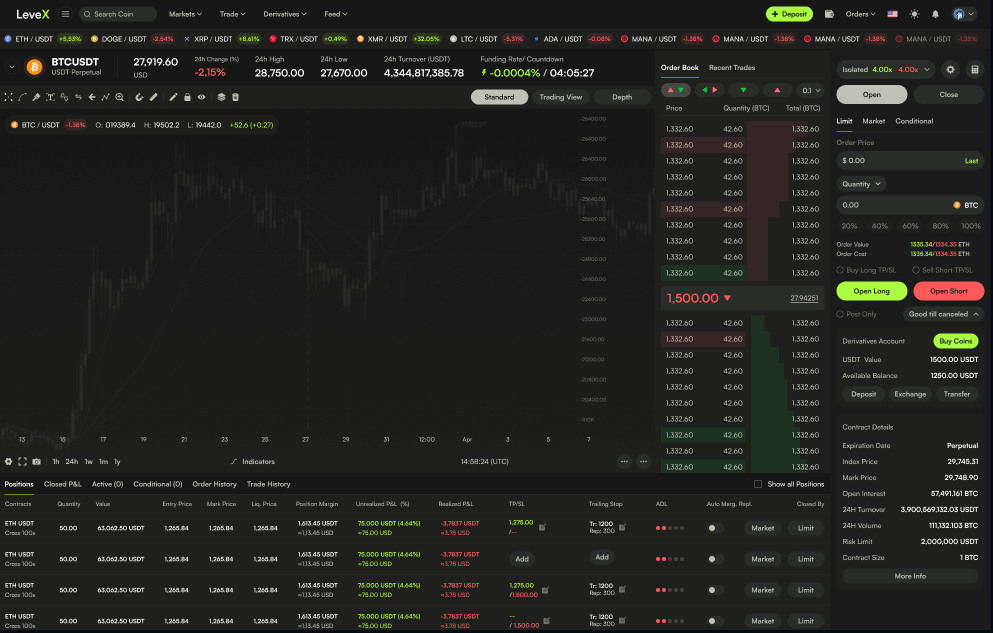

Futures on LeveX: Perpetual Contracts

Crypto Perpetual Contracts are agreements between buyers and sellers to trade a particular cryptocurrency at a predetermined price, but unlike standard futures contracts, they don't have an expiration date. Imagine you want to bet on the future price of a cryptocurrency like Bitcoin, but without actually having to buy or sell the Bitcoin itself. With a Crypto Perpetual Contract, you can do just that, and the contract continues indefinitely until either party decides to close the position. These contracts are often used for speculation, allowing traders to benefit from price movements without owning the underlying asset.

A Trader’s Journey

As a LeveX user, imagine you select a contract pair for trading, such as Bitcoin. You predict that the price of Bitcoin will fall, so you decide to "short" the contract. In this scenario, "shorting" means you're betting on the price to decrease. Your trading journey would look something like this:

- Opening the Position: You open a short position, agreeing to sell Bitcoin at a particular price, expecting it to fall later.

- Reacting to the Market: If your prediction is correct and the price does fall, you can close your position at any time you're happy with the profits. If you are wrong and the price goes up, you can also close the position to minimize losses.

- Waiting for a Change: Because these are perpetual contracts, you could keep your position open and wait for the price to swing in your favor. However, keeping a position open like this incurs a cost (funding fee), and there's a risk that if the price moves too far against you, the exchange might automatically close your position (liquidate) at a loss.

- Closing the Position: When you decide to close your position, the exchange's trading engine automatically calculates the profits or losses. Profits are equal to the difference between the starting and ending price if your prediction is right, and losses are the inverse if you are wrong.

- Settlement: The profits or losses are then automatically paid to or deducted from your account on the exchange.

This is a very simplified version of what trading perpetual contracts is like. There are many more interrelated concepts we recommend you learn to get a better understanding. For example, trading perpetual contracts also involve margin and leverage, tools that allow you to amplify profits but also increase risk. Understanding these elements in detail can provide a more comprehensive view of how perpetual contracts function and the considerations to take into account when trading them.

🔗 Connect & Thrive with LeveX

Follow us on our social media channels to stay up-to-date with the latest news, announcements, and exclusive offers.

Facebook 📘 | Twitter 🐦 | LinkedIn 🔗 | Instagram 📷 | YouTube 📺

For more information on related concepts, please refer to LeveX's User Guides or contact our dedicated Customer Support.