Understanding Funding Fees

Introduction to Funding Fees

Funding fees are periodic payments exchanged between the buyers and sellers of perpetual contracts in derivatives trading. These fees play a crucial role in ensuring that the trading price of a contract aligns with the underlying asset's market price. By understanding how funding fees work, traders can manage their positions more effectively and make informed decisions.

Why Funding Fees Are Necessary

In perpetual contracts, there is no expiration date, meaning positions can be held indefinitely. However, this can lead to the contract's price drifting from the underlying asset's price. Funding fees are designed to prevent this drift and keep the contract price tethered to the spot price.

How Funding Fees Work

Funding fees are typically exchanged between the buyers and sellers at regular intervals, often every 8 hours. The fee can be positive or negative, depending on the market conditions:

- Positive Funding Fee: If the contract is trading at a premium to the underlying asset's price, long positions (buyers) pay short positions (sellers). This encourages closing long positions and opening short positions, helping to push the contract price down towards the underlying price.

- Negative Funding Fee: If the contract is trading at a discount to the underlying asset's price, short positions pay long positions. This encourages closing short positions and opening long positions, helping to push the contract price up towards the underlying price.

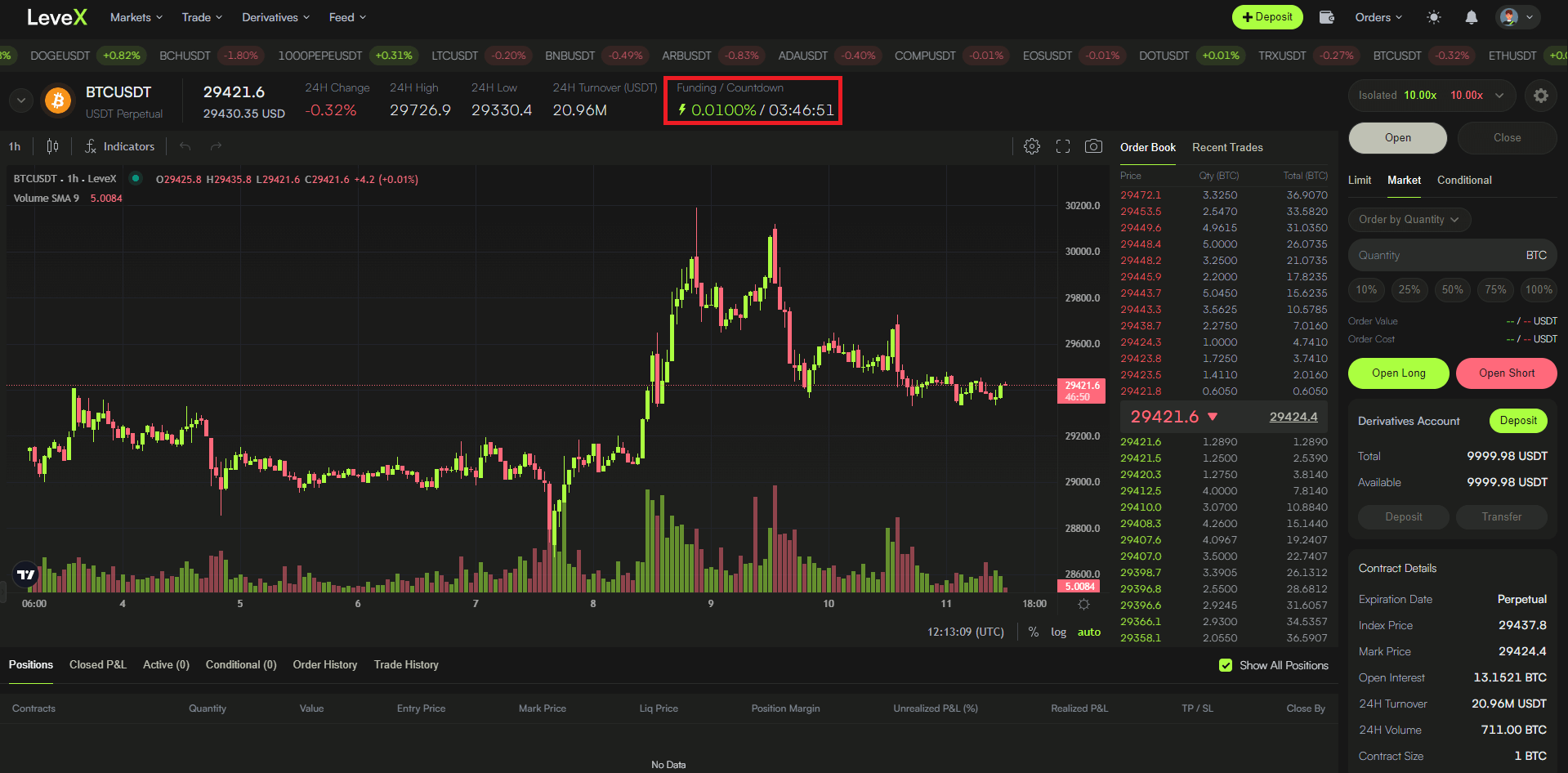

Funding Fees on LeveX

LeveX applies funding fees to its perpetual contracts to ensure the contract price closely follows the spot price of the traded asset. Traders can view the current funding rate and the next predicted rate directly on the trading interface.

Considerations for Traders

Funding fees may seem like a minor aspect of derivatives trading, but they can have a significant impact on a trader's profitability, especially for those holding positions over extended periods. Traders should:

Be aware of the funding intervals and rates for the contracts they are trading. Consider the cumulative effect of funding fees on their positions. Monitor market conditions that may lead to significant changes in the funding rate.

🔗 Connect & Thrive with LeveX

Follow us on our social media channels to stay up-to-date with the latest news, announcements, and exclusive offers.

Facebook 📘 | Twitter 🐦 | LinkedIn 🔗 | Instagram 📷 | YouTube 📺

For more information on related concepts, please refer to LeveX's User Guides or contact our dedicated Customer Support.